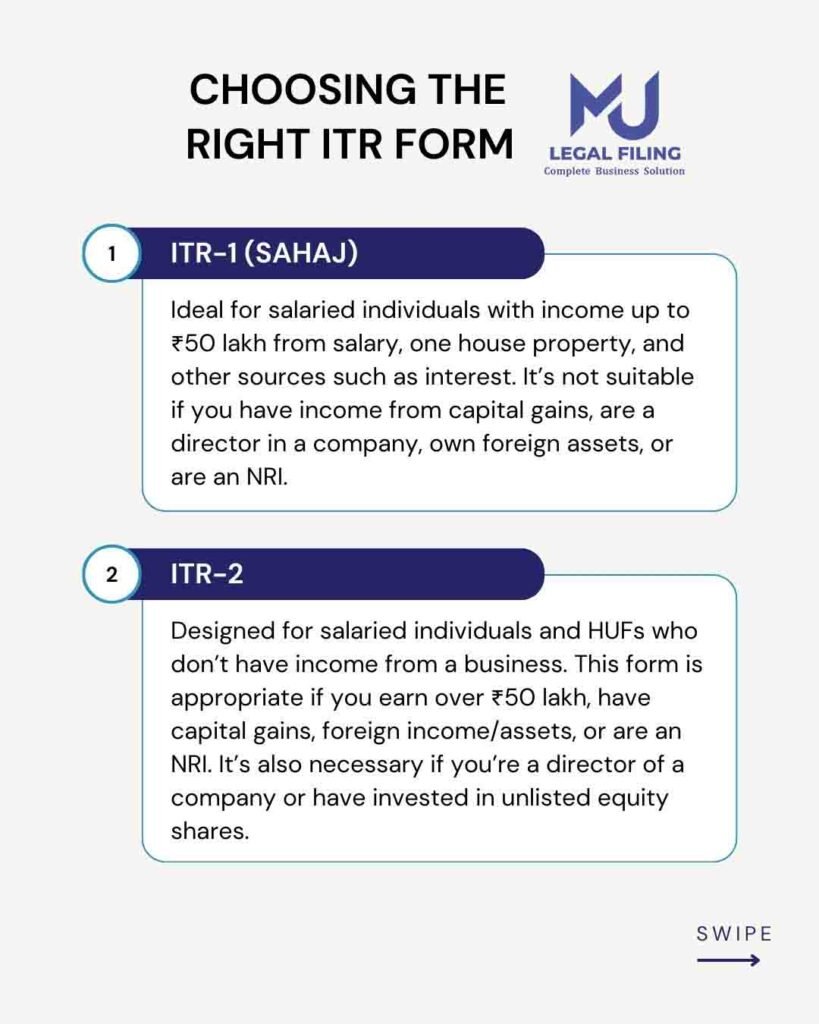

ITR-1 (SAHAJ)

Income Tax Form for Ideal for salaried individuals with income up to *50 lakh from salary, one house property, and other sources such as interest. It’s not suitable if you have income from capital gains, are a director in a company, own foreign assets, or are an NRI.

ITR-2

Designed for salaried individuals and HUFs who don’t have income from a business. This form is appropriate if you earn over 50 lakh, have capital gains, foreign income/assets, or are an NRI. It’s also necessary if you’re a director of a company or have invested in unlisted equity shares.

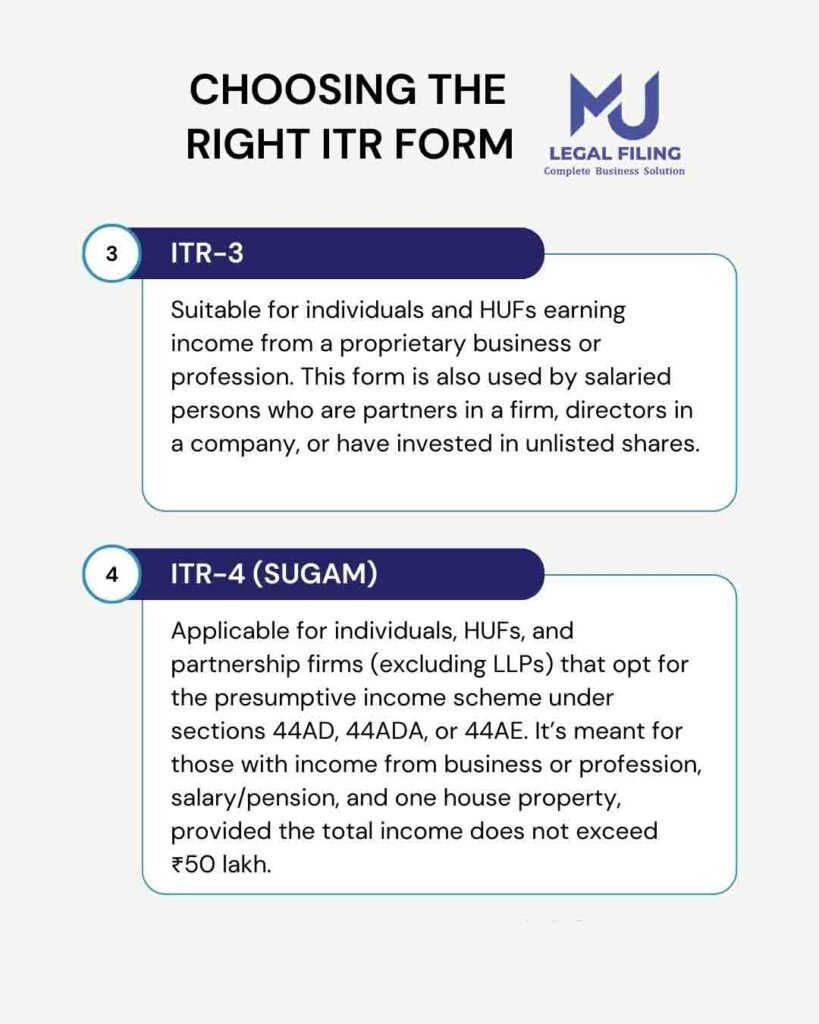

ITR-3

Suitable for individuals and HUFs earning income from a proprietary business or profession. This form is also used by salaried persons who are partners in a firm, directors in a company, or have invested in unlisted shares.

ITR-4 (SUGAM)

Applicable for individuals, HUFs, and partnership firms (excluding LLPs) that opt for the presumptive income scheme under sections 44AD, 44ADA, or 44AE. It’s meant for those with income from business or profession, salary/pension, and one house property, provided the total income does not exceed ₹50 lakh.

With MJ Legal Filing Tax Advisor, You’re Set to Win the Game. To Know Contact MJ Legal Filing

We will Help you fot Choosing the Right Income Tax Form