When I need to File ITR? A Comprehensive Guide Explained

File ITR not just because it is a statutory compliance but also to inform the Government as well as the tax authorities about your total income in a particular financial year. Consequently, filing of ITR acts as proof of your income.

Now comes the question,

Really Do you need to file ITR?

The person has to file ITR if his/her gross income or expenditure, or investment surpasses a certain threshold limit.

What is the threshold limit to file ITR?

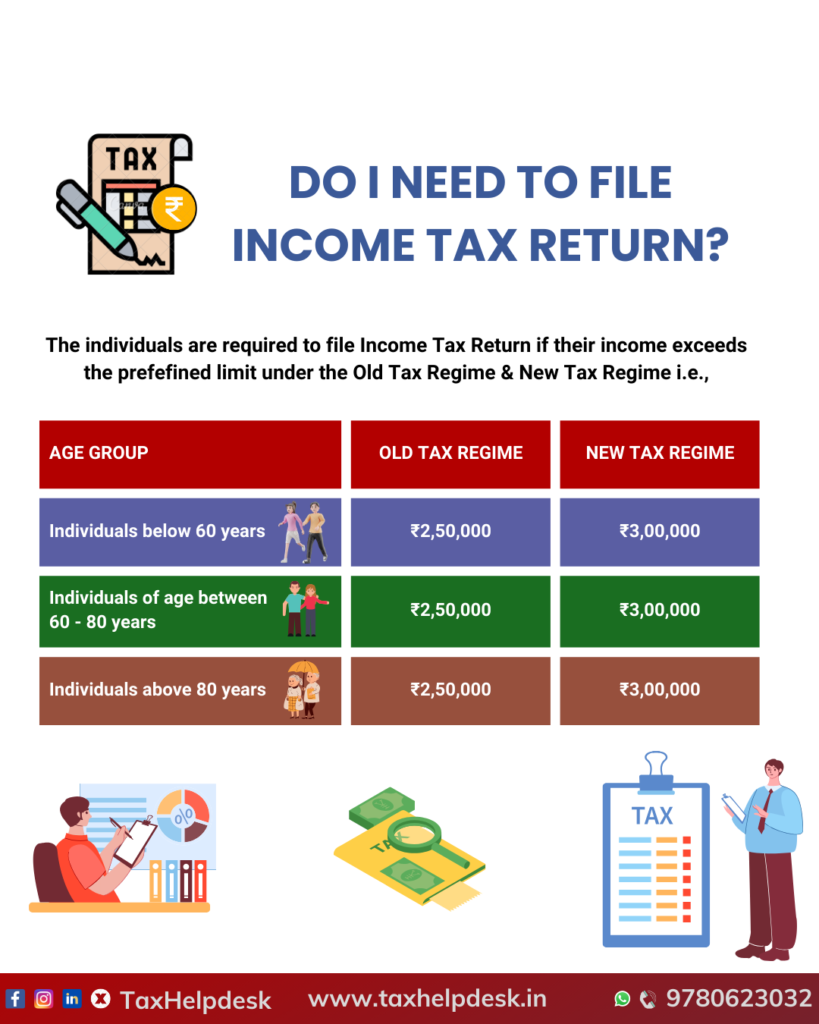

The certain limit to file ITR is different under the Old Tax Regime as well as the New Tax Regime. It is as follows:

Note:

– Under the Old Tax Regime, the individuals have to file Income Tax Return as per their income slab as well as their age group.

– Under the New Tax Regime, there is no distinction among the individuals on the basis of age.

– Old Tax Regime allows individuals to opt for all the deductions and exemptions but the Income Tax Slab rate is high.

– On the other hand, the New Tax Regime has lower Income Tax Slab rates but the individual will have to forego the majority of the exemptions and deductions.

Do you need to file the ITR even if your gross income is below the threshold limit?

There are cases where the individual’s gross income does not exceed certain limit, yet he/she has to mandatorily file the ITR. These cases are as follows:

a) Individual has spent an aggregate amount exceeding Rs 2 lakh for himself or any other person for foreign travel;

b) Individual has deposited an amount or aggregate of amounts exceeding Rs 1 crore in one or more current accounts;

c) The person has made deposits of Rs. 50 lacs or more in a savings account.

d) The business turnover exceeds Rs. 60 lacs in a financial year.

e) Professional receipts exceed Rs. 10 lacs in a financial year.

f) The total TDS/TCS amount is Rs. 25,000 or more.

g) Individual has paid electricity bill exceeding Rs 1 lakh on aggregate basis during the financial year;

h) Ordinarily resident individual having income from foreign countries and/or assets in foreign countries and/or having signing authority in any account outside India; and

h) If an individual’s gross total income exceeds the exemption limit before claiming tax exemption on capital gains under sections 54, 54B, 54D, 54EC, 54F, 54G, 54GA, or 54GB.

Other Cases where it is mandatory to file ITR

- Assessee is a company or a firm irrespective of whether it has income or loss during the financial year

- Assessee has to claim an income tax refund

- Assessee wants to carry forward a loss under a head of income

- Return filing is mandatory if assessee is a Resident individual and has an asset or financial interest in an entity located outside of India. (Not applicable to NRIs or RNORs)

- If assessee is a Resident and a signing authority in a foreign account. (Not applicable to NRIs or RNORs)

- Assessee is required to file an income tax return when he is in receipt of income derived from property held under a trust for charitable or religious purposes or a political party or a research association, news agency, educational or medical institution, trade union, a not for profit university or educational institution, a hospital, infrastructure debt fund, any authority, body or trust

Assessee is a foreign company taking treaty benefit on a transaction in India - A proof of return filing may also be required at the time of applying for a loan or a visa

Penalties related to late filing of Income Tax Return

– There is a late filing fees under Section 271F of the Income Tax Act amounting to Rs 5,000 for AY 2021-22, where such return is filed beyond the due date under Section 139(1) of the Income Tax Act. However, if the total income of the taxpayer is upto Rs 5,00,000, such late fees would be restricted to Rs 1,000.

– Additional interest under Section 234A of the Income Tax Act would be applicable @1% per month or part of the month for the amount of tax remaining unpaid.

– More importantly, the taxpayer would also lose out on certain deductions and/or set off and carry forward of losses (other than house property loss) as a result of filing the return beyond the due date prescribed under Section 139(1) of the Income Tax Act.